The Complete Guide to EMI Calculations

Financial Expert: Kardile Ajinkya

Table of Contents

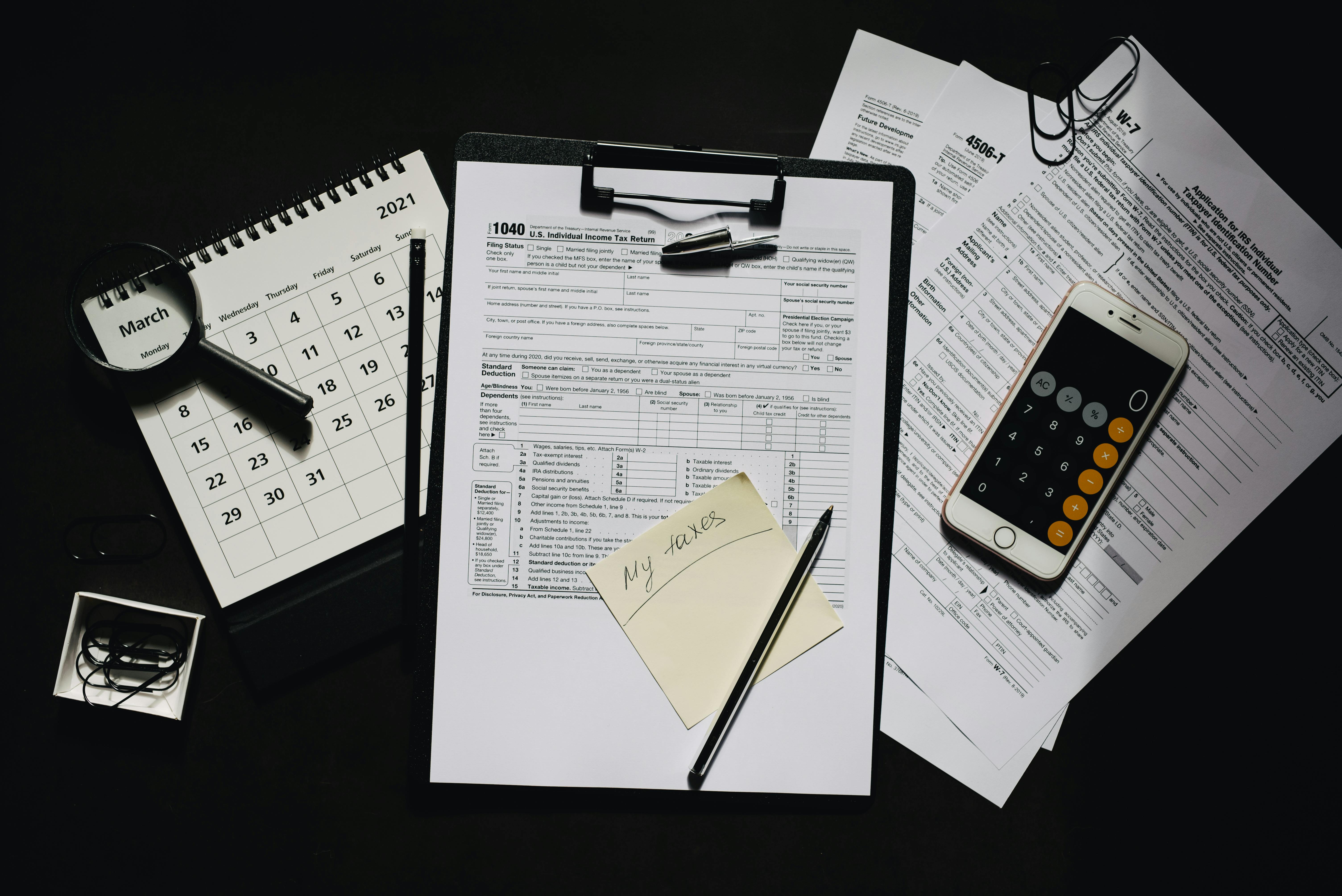

Introduction to EMI

Equated Monthly Installment (EMI) is a fixed payment made by a borrower to a lender on a specified date each month. EMIs cover both the interest and principal, allowing the loan to be paid off completely over a fixed period.

How EMI Works: The Math Behind It

The formula for calculating EMI is:

EMI = [P × R × (1+R)^N] / [(1+R)^N - 1]

Where:

- P = Principal loan amount

- R = Monthly interest rate

- N = Loan tenure in months

Practical Example

If you take a loan of ₹10,00,000 at an annual interest rate of 9% for 15 years (180 months):

R = 9% / 12 = 0.75% = 0.0075

EMI = [10,00,000 × 0.0075 × (1+0.0075)^180] / [(1+0.0075)^180 - 1]

EMI ≈ ₹10,142.67

Factors Affecting Your EMI

Several factors influence the EMI amount:

- Loan Amount: A higher principal leads to a higher EMI.

- Interest Rate: Even minor rate changes significantly impact EMI.

- Loan Tenure: A longer tenure lowers the EMI but increases total interest.

- Type of Interest: Fixed vs. floating interest rates affect predictability.

- Prepayments: Making prepayments can reduce either your EMI or loan tenure.

Using Our EMI Calculator

Our easy-to-use EMI calculator simplifies the process:

- Enter the loan amount.

- Input the interest rate.

- Select the loan tenure.

- Instantly view the calculated EMI.

👉 Try it now at emicalculatortool.in to make informed decisions.

Benefits of Understanding EMI

Understanding EMI calculations helps borrowers plan finances with clarity and confidence. It aids in budgeting, allows meaningful comparison between lenders, and helps identify the most cost-effective borrowing options. Proper EMI planning can also prevent debt overload and promote long-term financial health.

EMI for Different Loan Types

Home Loans

Home loans involve larger amounts and longer tenures. Small interest rate differences can have a significant impact. Many lenders offer reduced rates for salaried individuals and women borrowers.

Auto Loans

Auto loans typically cover smaller amounts with shorter tenures. The EMI amount depends heavily on the down payment and interest rate.

Personal Loans

These are unsecured loans with higher interest rates and shorter durations. Due to the lack of collateral, EMIs on personal loans are generally higher.

Fixed vs. Floating Interest Rate: Which Is Better?

A fixed interest rate stays the same throughout the tenure, ensuring consistent EMIs and predictability in budgeting.

A floating interest rate varies with market conditions. It may start lower than a fixed rate but can increase over time, making EMIs unpredictable.

- Opt for fixed rates if you prefer stability and long-term planning.

- Choose floating rates if market conditions suggest declining interest or if you plan to repay the loan early.

Tips to Reduce Your EMI Burden

- Increase your down payment: Reducing the principal lowers your EMI.

- Opt for a longer tenure: A longer loan duration results in smaller EMIs (though more interest paid overall).

- Negotiate the interest rate: A strong credit profile can help you secure lower rates.

- Balance transfer: Shift your loan to another lender offering better terms.

- Make part-prepayments: Reducing the outstanding principal helps lower future EMIs or shorten the loan tenure.

Common Mistakes to Avoid

- Focusing only on EMI: Always evaluate the total interest paid over the loan term.

- Ignoring loan terms and conditions: Hidden charges and penalties can be financially damaging.

- Over-borrowing: Taking on a higher loan than you can afford strains monthly finances.

- Neglecting your credit score: A low score can lead to rejections or higher interest rates.

Conclusion

Mastering EMI calculations is essential for anyone planning to take a loan. With proper understanding, you can compare offers wisely, avoid costly mistakes, and manage your financial obligations with confidence. Use our EMI calculator at emicalculatortool.in to stay informed, stay ahead, and make every borrowing decision a strategic one.